18 Jun , 2025 | Blog

Mutual Funds vs. Beginners-Guide-to-Mypot-Gold

When it comes to growing your money, most people think of mutual funds. But in recent years, Mypot gold has also caught attention. It’s easy to buy. It feels safe. And for many, it’s more comfortable than stock markets and physical gold. But is it the right choice for long-term wealth creation? Or should you stick with mutual funds?

This blog will walk you through both options: Mypot gold vs mutual funds. We’ll look at how they work, what returns you can expect, the risks, and which suits different kinds of investors. Whether you’re new to investing or just unsure what to choose next, this guide can help you understand the basics and make a better decision.

Keep reading to see what fits your financial goals.

Conclusion

Both Mypot gold and mutual funds are good in their own way. Many smart investors even choose to do both, picking Mypot gold for stability and mutual funds for growth. It really comes down to your comfort, goals, and how hands-on you want to be.

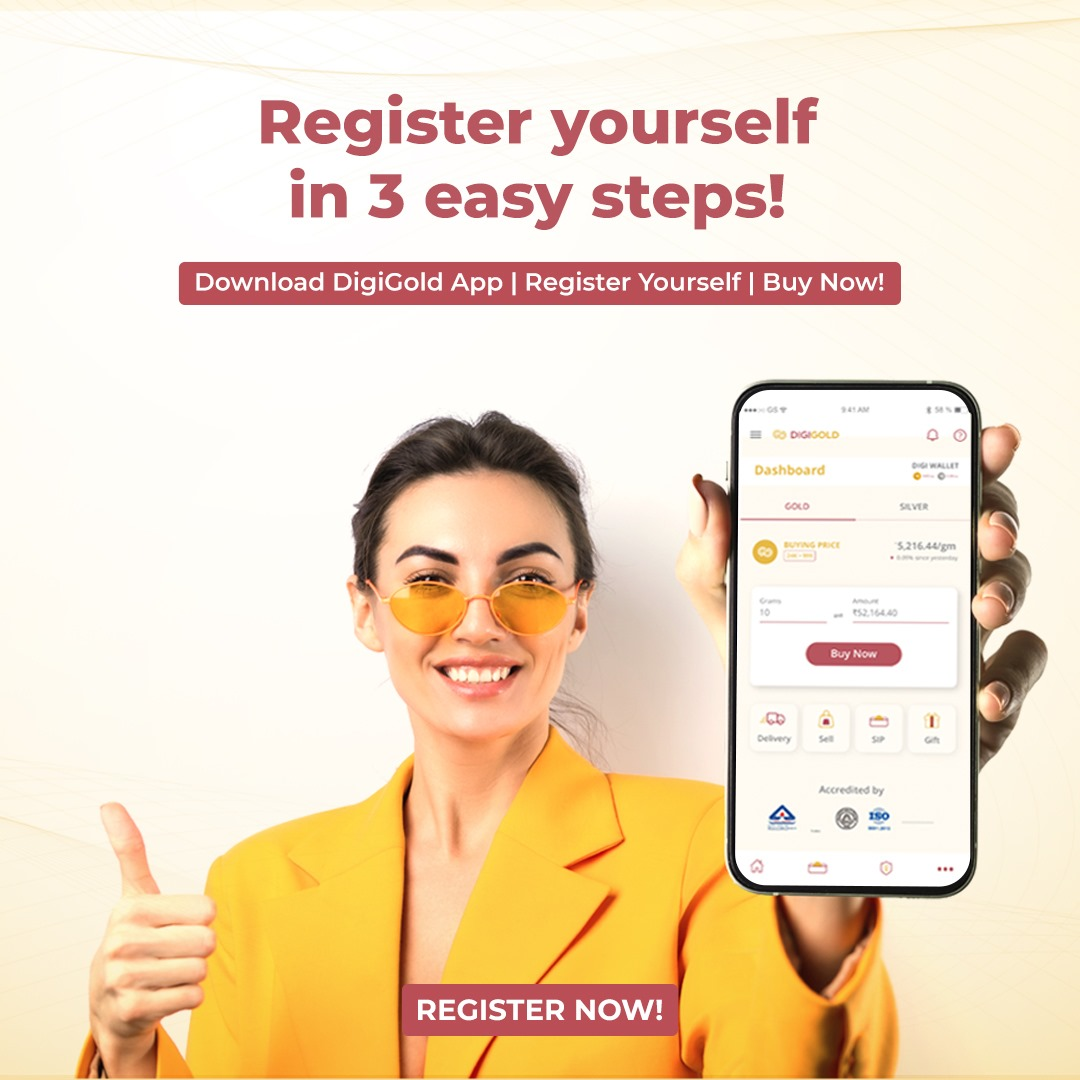

If you decide to invest in Mypot gold, make sure to go with a trusted platform like Mypot Gold. You can start your Mypot gold investment with as low as ₹1. We also offer a flexible Gold SIP with no locking period, starting at only ₹500 through easy periodic installments.

You get 24-karat gold with 99.9% purity, officially certified and securely stored. Simple, trusted, and built for your comfort. Planning big doesn’t mean starting big. Start small, go golden. Mypot Gold lets you build your gold ₹1 at a time.